theguardian:China and Russia: the world's new superpower axis?

source:theguardian

Reprint link:http://www.theguardian.com/world/2015/jul/07/china-russia-superpower-axis

Forget euro summits and G7 gatherings: for the countries that like to style themselves as the world’s rising powers, the real summitry takes place this week in central Russia, where Vladimir Putin will hold court.

Leaders of the Brics countries (Brazil, India, China and South Africa) will meet Putin in Ufa on Wednesday, then make way for the Asian powers grouped in the Shanghai Cooperation Organisation.

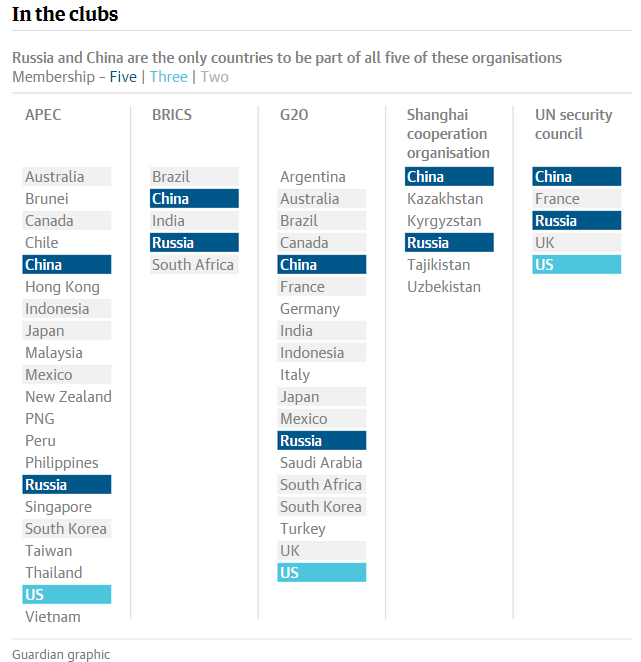

Russia and China are the common denominators, as in so much geopolitics these days. The UN security council, Apec, the G20 - Russia and China are the ever-presents, a powerful pairing whose interests coincide more often than not.

Moscow and Beijing have lots in common apart from a 2,500-mile border, economies dominated by state-run firms and oligarchies that can enrich themselves as long as they play by the prevailing political mood of the day.

Officially, Putin is dismissive about suggestions of a new eastern alliance. “We are not creating a military alliance with China,” he said last month. “We are not creating a bloc-based approach, we are trying to create a global approach.”

And yet both countries share a desire to limit American power; they enjoy a burgeoning trade relationship in which, in essence, hydrocarbons are swapped for cheap consumer goods; and they have a mutual interest in promoting an alternative model to western diplomacy.

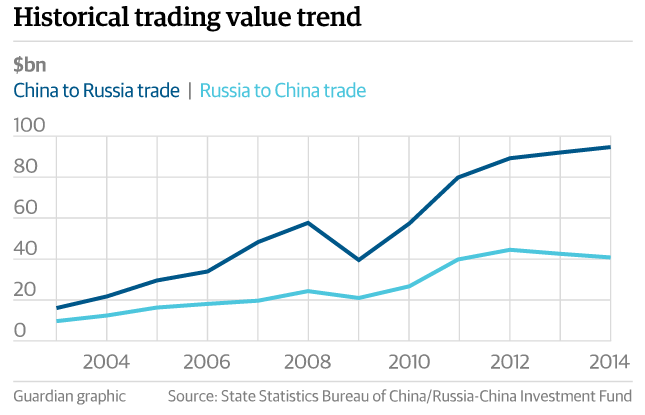

Trade has increased sixfold over the past decade. Last year they trumpeted the biggest gas deal in history. The summer will be bookended by two striking events: Russian and Chinese warships puttering about together in the eastern Mediterranean in May, gaming war; and Russian and Chinese presidents standing shoulder to shoulder in Beijing for the 70th anniversary of the end of the second world war in September.

So how robust is the Russia-China axis?

Geopolitics

For China, one of the main attractions of closer relations with Russia is the potential for challenging Washington’s still dominant global position.

“In China, where until recently the official line was ‘non-alignment’, some prominent scholars have started to make unambiguous calls for a comprehensive strategic alliance with Russia,” Alexander Korolev, at the National University of Singapore’s centre on Asia and globalisation,argued recently. “[They are] arguing on the pages of the CCP [Communist party] central party school’s internal publications that ‘China-Russia strategic relations are the most substantive ones’ and elsewhere that ‘China will be unable to shift the world from unipolarity to bipolarity unless it forms a formal alliance with Russia.’”

But often cooperation and tension are two sides of the same coin. Take Central Asia. China’s president, Xi Jinping, has set his sights on a “new silk road”, using China’s billions to help neighbours and regional allies to develop, indirectly supporting growth at home and the expansion of Chinese soft power.

However, this is also Russia’s traditional sphere of influence and any Chinese presence that goes beyond commercial dealings is likely to raise hackles in Moscow.

“It’s totally possible for China to develop its relations with central Asian countries without challenging Russia,” said Liu Jun, a Russian studies expert at East China Normal University. “It’s true that Russia would be concerned if China’s influence in Central Asia grew too much, but the concerns are not mainstream in the bilateral relations – there are more benefits in cooperation than otherwise.”

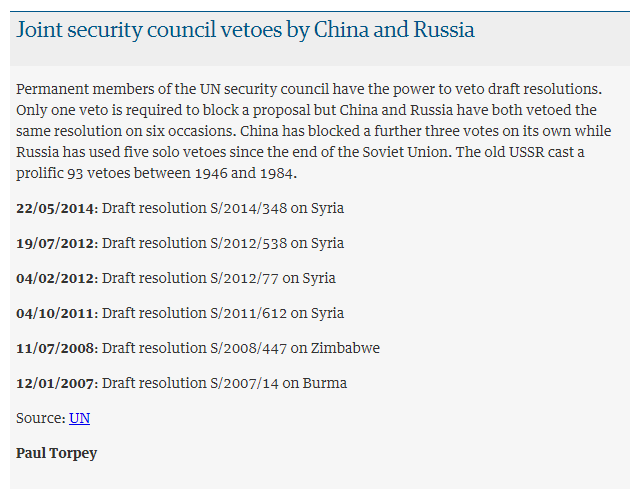

Russia shares the strategic goal of challenging US hegemony in favour of a more multipolar world, and the two powers often find themselves on the same side in the UN security council, where they wield vetoes as permanent members.

No deal on regulating Iran’s nuclear programme can be made without Russia and China, which have staunchly backed its atomic expansion in the past, and the two countries’ support is largely the reason Bashar al-Assad has been able to hold on to power in Syria. Recently, Russia has been making political and economic overtures to North Korea, which relies on food, arms and energy from its key ally, China, to survive.

As they support the idea of a multipolar world against American dominance, Moscow and Beijing will also tacitly back each others’ attempts to defend their own spheres of influence, said Dmitry Trenin, director of the Carnegie Moscow Centre. In the past two years, Russia has annexed Crimea and backed a separatist campaign to frustrate Ukraine’s turn to the west, and China has been disputing islands with western allies in the South China Sea.

“China admits de facto that Russia has interests in eastern Europe, Russia admits that China has interests around the perimeter of its borders, and even though neither will actively help its partner in Ukraine or the South China Sea, both will observe an advantageous neutrality,” Trenin said. “There won’t be criticism of each other in the areas of their core interests.”

Leadership

Government enthusiasm for warmer ties with Russia is summed up by a recent video from the state-controlled Xinhua news agency entitled What Do Chinese People Think About Russia?”

It features Chinese children describing Russia as “even bigger than China”, an old man praising Russia’s strength, demands for more investment, gas sales, a high-speed train, and plenty of airtime given to adulation of the Russian president.

Putin has long been popular in China, where he is seen as a strong leader who has bolstered national pride, and is not a little admired for his topless photo shoots. “Putin you’re a handsome man,” says one middle-aged woman on being asked what message she would like to send to Moscow.

There is also an overt comparison to Xi, who has fostered a personality cult of bold leadership that has echoes of the Russian leader’s (though with less bare flesh). “Putin is the same as our ‘Papa Xi’,” says one young man, using a government endorsed affectionate term for the president.

For their part, Russians are more ambivalent about Xi, who has a far lower profile in Russia than does his counterpart in China.

Trade

China’s interest in Russian exports has until now been largely focused on natural resources and military hardware. Beyond that they do not make natural partners. Russia can offer little by way of famous brands or innovation in consumer technology to tempt ordinary Chinese customers.

“It’s a good thing that there is political will behind the business cooperation. Without it, a lot of things won’t happen,” Liu said. “Most big projects are backed by the governments and the volume of trade along the border is quite small.”

The imbalance of the relationship can be seen in the breakdown of their bilateral trade, worth around $100bn a year. China is Russia’s second largest trading partner after the EU, while Russia only just scraped into a list of China’s top 10 trading partners, accounting for barely 3% of the country’s total trade volume.

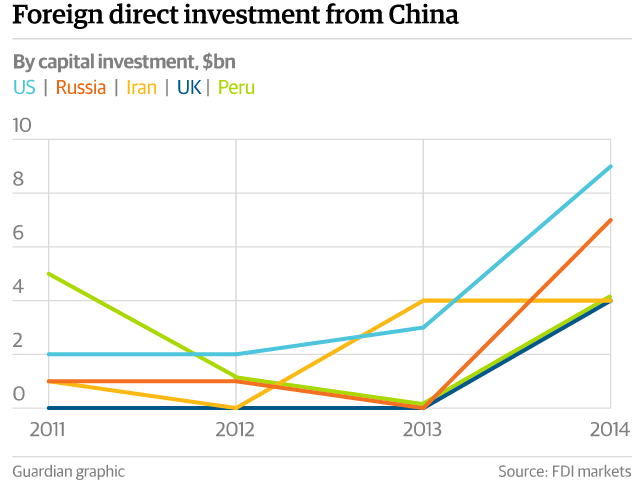

Moscow is also hoping Beijing will help with finance for businesses, after western funds dried up last year. Some Chinese firms have seen the Russian economic wobble as an opportunity to make capital investments in the country.

Energy

China and Russia should make natural partners in energy deals, but in reality they have struggled to turn past agreements into real supply deals; pipelines announced last decade have still not been built because of disagreements over pricing and other conditions.

Earlier this year, Russia overtook Saudi Arabia as the largest supplier of oil to China for the first time, with Russian exports to China more than doubling since 2010. But Beijing is accustomed to shopping around for energy and driving a very cheap bargain with its suppliers, while Russia is used to controlling prices for European customers with few other options.

The expansion of shale gas production may have weakened Russia’s hand by improving global supply, but China is also increasingly concerned about climate change and needs to wean itself off the dirty coal that still provides well over half its energy.

Since Russia has rarely agreed to sell stakes in strategic land-based deposits to western companies, Putin’s offer of a stake in state oil champion Rosneft’s biggest production asset, the Vankor oilfields, to China in September underlined the new direction the country’s energy policy is taking.

The offer was made at a ceremony to start construction of Russia’s $55bn Power of Siberia pipeline, a breakthrough project that is planned to deliver an annual 38bn cubic metres of gas to eastern China over the next 30 years. In November, the two countries also signed a framework agreement for an Altai gas pipeline to potentially supply 30bn cubic metres of gas to western China each year for 30 years.

But neither pipeline deal appears to have been completely finalised, and economic sanctions and a weak rouble will probably make financing the huge projects difficult for Russia’s Gazprom.

“It seems like at every meeting there’s some sort of document signed and hailed as another big agreement … but Gazprom will need to develop large fields and construct the pipelines,” said Grigory Birg, an analyst at Investcafe. “I think in the current environment securing the finances is the major holdup, and we don’t have any indication as to the economics of the project.”

Although Birg estimated the rate of return on the Power of Siberia investment to be a modest 9% to 10% when the deal was signed, the profitability is likely to be even less if global oil prices remain weak. Beijing will, by all appearances, be able to drive an even harder bargain for the gas price under the proposed Altai pipeline to western China, a region that has less demand than the industrialised east of the country and already receives cheap gas from nearby Turkmenistan.

Nonetheless, analysts expect energy cooperation to continue to grow as Russia seeks alternatives to the politically thorny European market, and China addresses growing demand and problems with pollution and blackouts. Last year, China replaced Germany as Russia’s biggest buyer of crude oil. “China is the major alternative market and is easily accessible for Russia given the [location of energy] reserves and the geopolitical partnership, so it’s an obvious fit,” Birg said. “But the timing at which it is happening is not in favour of Russia.”

Currency

Both Russia and China have an interest in loosening the US dollar’s dominance in global trade as the world’s reserve currency. Russia now accepts yuan for oil payments (something that other oil exporters, such as Saudi Arabia, don’t do).

Following the imposition of sanctions, Russian companies and banks – traditionally reliant on dollar-denominated syndicated loans – started to look to China for a financial escape route. The rouble-yuan currency pair reached records in trading volumes last summer.

Russian companies are not new to the renminbi market, nor to the issuing of “dim sum bonds” – bonds denominated in Chinese yuan and largely issued by entities based in China or Hong Kong. In the past these options represented a cheaper source of funding. Now they’re a necessity. However, yields on Russian corporate bonds denominated in yuan have increased as the list of sanctions started mounting up.

Military

Russian arms sales to China have been estimated at $1bn a year, the Russians were previously hesitant to give advanced weaponry to the Soviet Union’s one-time military rival. But the recent announcement by Russia’s state arms exporter of a deal to supply China with its S-400 surface-to-air missile systems has taken their relationship to a new level at a time when Beijing is seeking new air and naval defence technologies.

The higher-level arms sales have been accompanied by greater military cooperation, which was on display in May with the war games in the Mediterranean Sea. Such exercises in what has traditionally been a “Nato pond” are designed to expand the Chinese navy’s reach while showing the United States that Russia is a potentially important military partner, according to Trenin.

Following the Ukraine crisis, which soured relations with the west, he said the main considerations behind Russia’s “entente” with China were political. “Now Russia has an important stimulus to grow relations with China, because relations with the west are troubled, and China is the only large player in the world that can be considered as economic, political and to a certain extent military ally,” Trenin said.

Both sides, meanwhile, are concerned that the unrest in Pakistan and Afghanistan could spill over into their territory, or serve as incubators for militants who may one day return home.

But none of that means that either side has forgotten past disputes or present differences. Russia is nervous about China sapping its revenue by reverse engineering the equipment it buys, and is also monitoring Beijing closely for any attempts to project military power into central Asia.

“China and Russia’s strategic partnership is a result of the times, but it is totally different from a military alliance such as the one between the US and Japan,” the Global Times, a Chinese nationalist tabloid, said in a recent editorial.

“China and Russia have repeatedly stated that they will become partners, not allies. They do mean that. China also cares about relations with western countries. Russia does not want to see relations with the west become a deadlock.”

Cyber security

Both Russia and China share a concern over the US domination of the internet. In January, Russia, China and a number of central Asian dictatorships jointly submitted a new proposal for an international code of conduct on information security to the UN general assembly.

In a clause clearly aimed at the US, the document calls for countries “not to use information and communications technologies and … networks to interfere in the internal affairs of other states or with the aim of undermining their political, economic and social stability”.

At a recent internet security forum in Moscow, officials from both countries called for a new approach to online security.

“It’s great they [the US] invented the iPhone but when you open your iPhone and see the camera you have to guess whether it’s photographing you at that moment or not,” said Konstantin Malofeyev, a controversial businessman known for his backing for the Russian Orthodox church and the pro-Russian separatist movement in east Ukraine. “Russia went into space first and Antarctic first but we don’t control those things, they are controlled by international charters. Why should the US control the internet?”

Chinese official Chen Xiaohua said: “We should join hands to build cyberspace order. Various countries share a consistent vision of enhancing the governance of cyberspace … following the principles of mutual trust and mutual respect.”

In the meantime, Beijing and Moscow signed a landmark cyber-security dealrecently that could bolster defence against external attack as well as allowing them to share technology for domestic control.

The two countries have poured resources into managing the internet, aiming to curb its potential as a platform for dissent. Beijing’s “great firewall” is a powerful and sophisticated filter of the online world, but is still porous enough that most people inside China do not need to bother trying to evade it.

Both countries also field armies of both hackers and paid pro-government commenters, known in China as the “50 cent” group, because of how much they are paid for each post. However, experts say their focus on internal controls may have come at the expense of security.

“Prioritising political information control over technical cyber defence also damages China’s own cybersecurity,” Jon Lindsay of Harvard University’s Belfer centre for science and international affairs said in a recent briefing. “Lax law enforcement and poor cyber defences leave the country vulnerable to both cyber criminals and foreign spies.”

Business mood

Among some business people, there is a fear that the enforced turn to the east will mean Russia selling out from a position of weakness.

“The downturn in relations with the west is bad for Russia and bad for the west; the only beneficiary is China,” one top Russian businessman said. “The number of Chinese delegations coming to Russia has gone up tenfold, and the Chinese will only enter the market when they see the conditions are very beneficial to them.”

Russian media have been told to play up links with China and other non-western countries, and companies have felt pressure from the government to look eastwards even if it makes little business sense. But what initially seemed pointless may be starting to bear some fruit.

“It started as theatre, but now there are some companies out there really getting stuff done,” said Tom Blackwell, CEO of EM, a consultancy firm that has worked with a number of major Russian companies on exploring the Chinese market. “Chinese investment funds have very little experience or knowledge about Russia and it’s a hard sell. But the strategy seems to be to do the big state deals first and assume smaller ones will follow. Slowly, real things are happening.”

Russia’s federal migration service is especially wary of an influx of Chinese migrants across the Russia-China border. It has stated that Chinese could become the largest ethnic group in Russia’s far east by the 2020s or 2030s; last summer a border official said that 1.5 million Chinese illegally entered the region from January 2013 to June 2014.